PCI DSS Certification in Dubai

The Payment Card Industry Data Security Standard (PCI DSS) is a set of data security standards. So, it is designed to ensure that all companies maintaining a secure environment actively accept, process, store, or transmit credit card information.

Learn about the top certification and compliance services available for ensuring PCI DSS compliance. Protect cardholder data and achieve compliance seamlessly. Contact us today!

Let Eshield help you achieve PCI DSS compliance with ease. We offer customized solutions to fit your unique business needs and ensure data security.

What is PCI DSS in UAE?

PCI DSS certification refers to verifying that a business or organization has met the requirements of the Payment Card Industry Data Security Standard (PCI DSS). This certification is achieved through a process established by major credit card companies. Thus, they have created a set of security standards to ensure that businesses actively maintain a secure environment for processing, storing, or transmitting credit card information. To learn more, you can visit the website of pcisecuritystandards.

To become certified, a business must undergo a formal assessment by a Qualified Security Assessor (QSA) to confirm that they have implemented the necessary security controls and procedures required, aiming for PCI certification.

Once the assessment is complete, the QSA will issue a report that highlights any areas of non-compliance and provides recommendations for remediation. If the business successfully meets all the requirements, they will be granted certification and authorized to display the PCI DSS compliance logo. However, it is crucial to note that certification must be maintained through ongoing monitoring and periodic assessments.

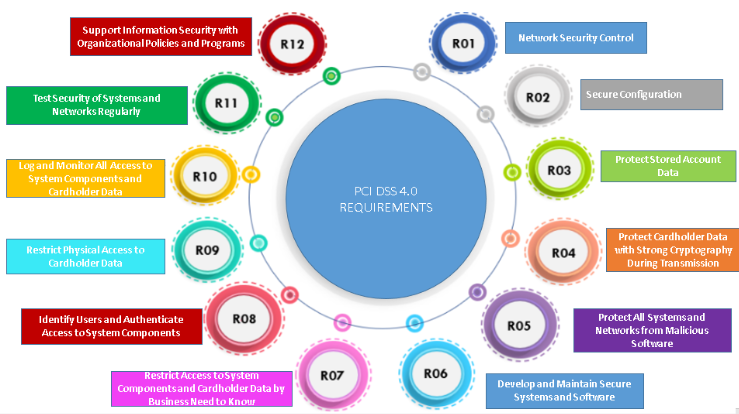

PCI DSS Requirements In A Nutshell

Benefits of PCI DSS Certification in UAE!

-

Improved security:

This certification requires organizations to establish strong data security measures actively. These measures are crucial in securing payment card data and can effectively help prevent data breaches and fraud.

-

Customer trust is increased:

By obtaining this PCI DSS certification for IT services, businesses can actively demonstrate to their customers that they prioritize data security. Furthermore, this demonstration can play a vital role in establishing trust and confidence in their brand, especially for merchants achieving PCI certification.

-

Avoiding costly fines:

Failure to comply with PCI can result in significant fines and penalties. However, it can be avoided by acquiring ISO certification in UAE, or alternatively focusing on PCI DSS compliance services for more industry-specific standards.

-

Competitive benefit:

Moreover, in areas where compliance is needed, certification can provide a competitive edge over non-certified competitors. Thus, demonstrating a commitment to data security and compliance with industry standards.

-

Brand reputation protection:

A data breach can substantially impact a company’s reputation in a negative way. Therefore, businesses can actively demonstrate to their consumers that they prioritize data security. Thus, obtaining the ISO certification in Dubai shows their commitment to safeguarding sensitive information.

Types of Services we provide, including PCI DSS compliance services and PCI DSS implementer certification training.

- PCI DSS compliance assessment and verification services: Compliance assessment and verification services are crucial for any merchant handling cardholder data, ensuring they meet industry standards.

- PCI DSS implementation support

- PCI QSA certification

- PCI DSS current state assessment

- PCI DSS compliance roadmap and strategy

- PCI DSS health check assessment

- PCI DSS SAQ selection and certification.

Eshield’s Methodology

-

Project Plan and PCI Overview:

Project Plan:

The project plan ensures that all team members are on the same page and thus, helps to keep the project on track. However, the key components of a project plan typically include:

- Project Scope: Define the objectives and deliverables of the project.

- Project Schedule: Define the timeline of the project, including key milestones and deadlines.

- Resource Management: Identify the resources needed to complete the project, including personnel, equipment, and budget.

- Risk Management: Identify potential risks and develop a plan to mitigate them, ensuring PCI DSS compliance services are included for those handling cardholder data.

- Communication Plan: Outline the communication strategy for the project team and stakeholders, incorporating the roles of PCI QSAs and the importance of PCI certification for merchants.

-

PCI Compliance:

The PCI DSS contains 12 requirements, which are grouped into six categories, essential for safeguarding cardholder data.

- Build and Maintain a Secure Network

- Protect Cardholder Data

- Maintain a Vulnerability Management Program

- Implement Strong privileged Access Control Measures

- Regularly Monitor and Test Networks

- Maintain an Information Security Policy

-

Scope Evaluation:

Our QSA team will discuss the business process and understand the requirements and based on that we will finalize the Scope.

-

Audit:

The PCI QSAs carry out both the audit and validation of PCI Compliance, ensuring all merchants meet the stringent requirements for handling cardholder data.

-

GAP Assessment:

Based on the audit our team responsible for PCI Audit assesses the current status of your organization’s PCI Compliance.

-

GAP Remediation:

Our experts in PCI Compliance consulting Services can assist you in identifying appropriate solutions that could accelerate your remediation process.

-

AOC and COC Release:

For compliance purpose we will issue the Attestation on Compliance and Certificate on compliance.

-

ROC Release:

Finally, within a month after the release of the Attestation on Compliance we will share the Report on compliance.

Questions and Answers related to PCI DSS

Q: What is PCI DSS compliance and why is it important?

A: PCI DSS (Payment Card Industry Data Security Standard) compliance refers to the set of requirements that ensure the secure handling of cardholder data. It is important because non-compliance can result in data breaches, financial losses, and damage to reputation.

Q: How can I achieve PCI certification for my business?

A: To achieve PCI certification, you need to implement the necessary security measures, conduct a formal assessment of your compliance by a Qualified Security Assessor (QSA), and submit a compliance report to the PCI Security Standards Council.

Q: What is the role of a QSA in PCI DSS implementation?

A: A Qualified Security Assessor (QSA) is a professional who is certified to assess and validate an organization’s compliance with PCI DSS requirements. QSAs play a crucial role in helping businesses achieve and maintain PCI compliance.

Q: What is penetration testing in the context of PCI DSS?

A: Penetration testing is a security testing method where assessors simulate real-world cyber attacks to identify vulnerabilities in a system. It is a mandatory requirement for PCI DSS compliance to ensure the security of cardholder data.

Q: How does PCI risk assessment help in maintaining compliance?

A: PCI risk assessment involves identifying, prioritizing, and mitigating risks to cardholder data. By conducting regular risk assessments, businesses can proactively address security vulnerabilities and maintain PCI compliance.

Q: What is involved in the PCI DSS certification program?

A: The PCI DSS certification program includes implementing security controls, conducting assessments, achieving compliance validation by a QSA, and obtaining a compliance certificate from the PCI Security Standards Council.

Q: How can businesses get support for PCI remediation?

A: Businesses can get support for PCI remediation by working with security providers or consultants who specialize in helping organizations address security vulnerabilities, implement necessary changes, and achieve PCI compliance.

Q: What are PCI remediation reviews and why are they important?

A: PCI remediation reviews involve assessing implemented security measures to ensure they effectively address identified vulnerabilities. These reviews are crucial in maintaining continuous compliance with PCI DSS standards.

Related Services

- Managed SOC

- Vulnerability Assessment: Vulnerability Assessment, an essential part of PCI DSS compliance services to protect cardholder data

- PCI ASV Scanning

- Penetration Testing

- User Awareness Training, often a requirement for achieving PCI certification, emphasizing the safe handling of cardholder data

- Secure Code Development Training

- Incident Management Training